what is bear trap in investing

In the stock market traders depend on technical indicators to help them trade effectively. Identifying a Bear Trap.

Bear Trap Best Strategies To Profit From Short Squeezes Tradingsim

The best way to avoid a bear trap and avoid loss is to identify a bear trap and take positions accordingly.

. Investors who have bet against the. Actionable Investing Ideas and Trends You Can Use to Help Clients Pursue Their Goals. Bear trap trading is the unanticipated behavior of a stock that lures bearish investors into false positions that can hurt your portfolio.

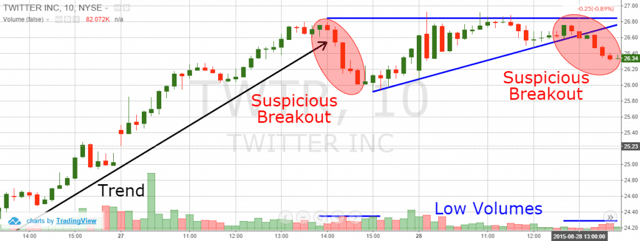

This pair had formed a. The bear trap is a tricky market situation that involves the potential of losing money. A bear trap is a condition in the market where the expected downward movement of prices suddenly reverses up.

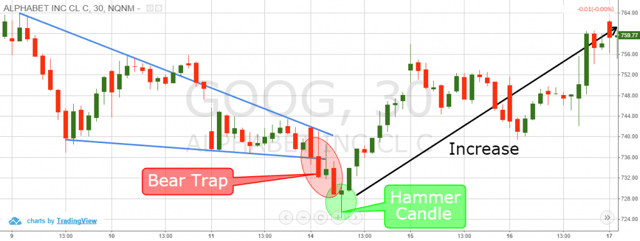

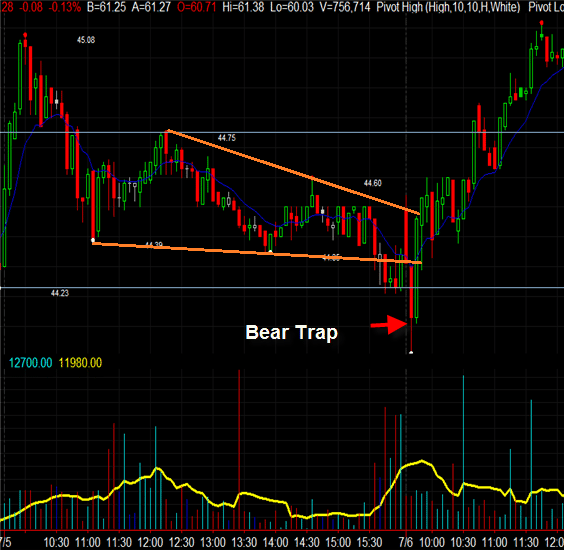

As we can see GBPUSD is trading on a bullish trend on the daily chart. A bear trap is a market pattern that occurs when the asset price breaks suddenly below the support level only to reverse immediately. When prices in an uptrend abruptly drop a bear trap follows.

A bear trap is a trading term used to describe market situations that indicate a downturn in prices but actually leads to higher prices. A bear trap has the potential for creating a great deal of revenue for the investor. For example when there are a lot of people.

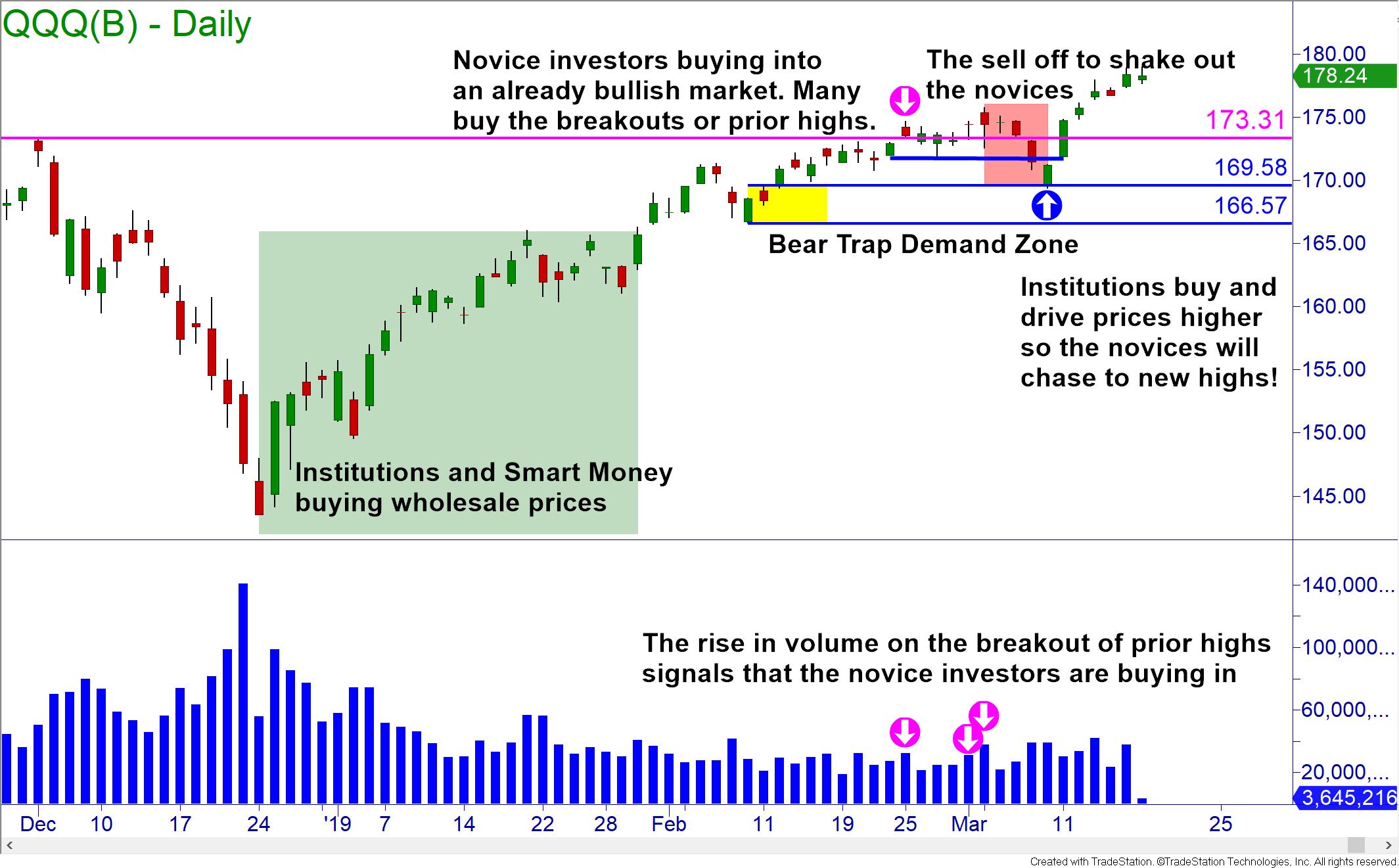

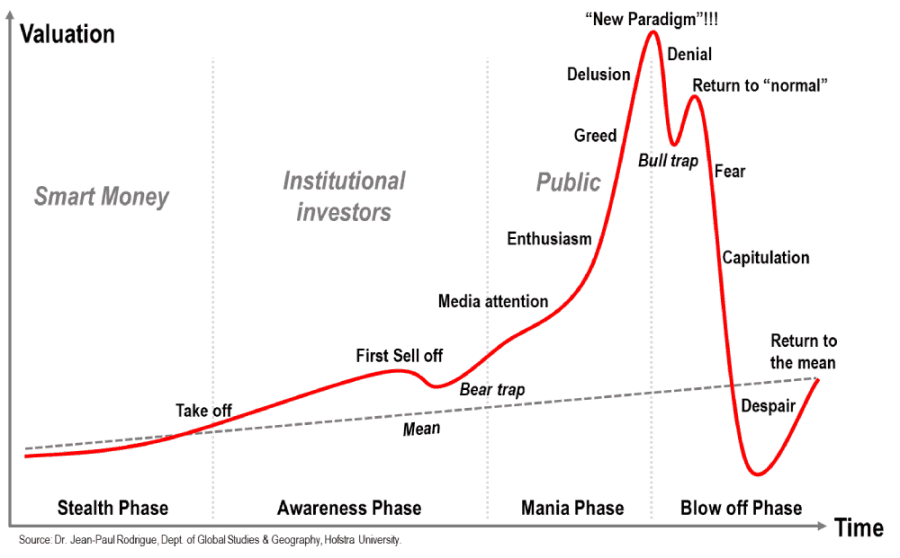

In general a bear trap is a technical. A bull trap is a false buying signal that occurs when an equity that has been in a declining pattern quickly reverses direction. Institutional investors may seek to stimulate interest in a stock which encourages retail investors to sell and take.

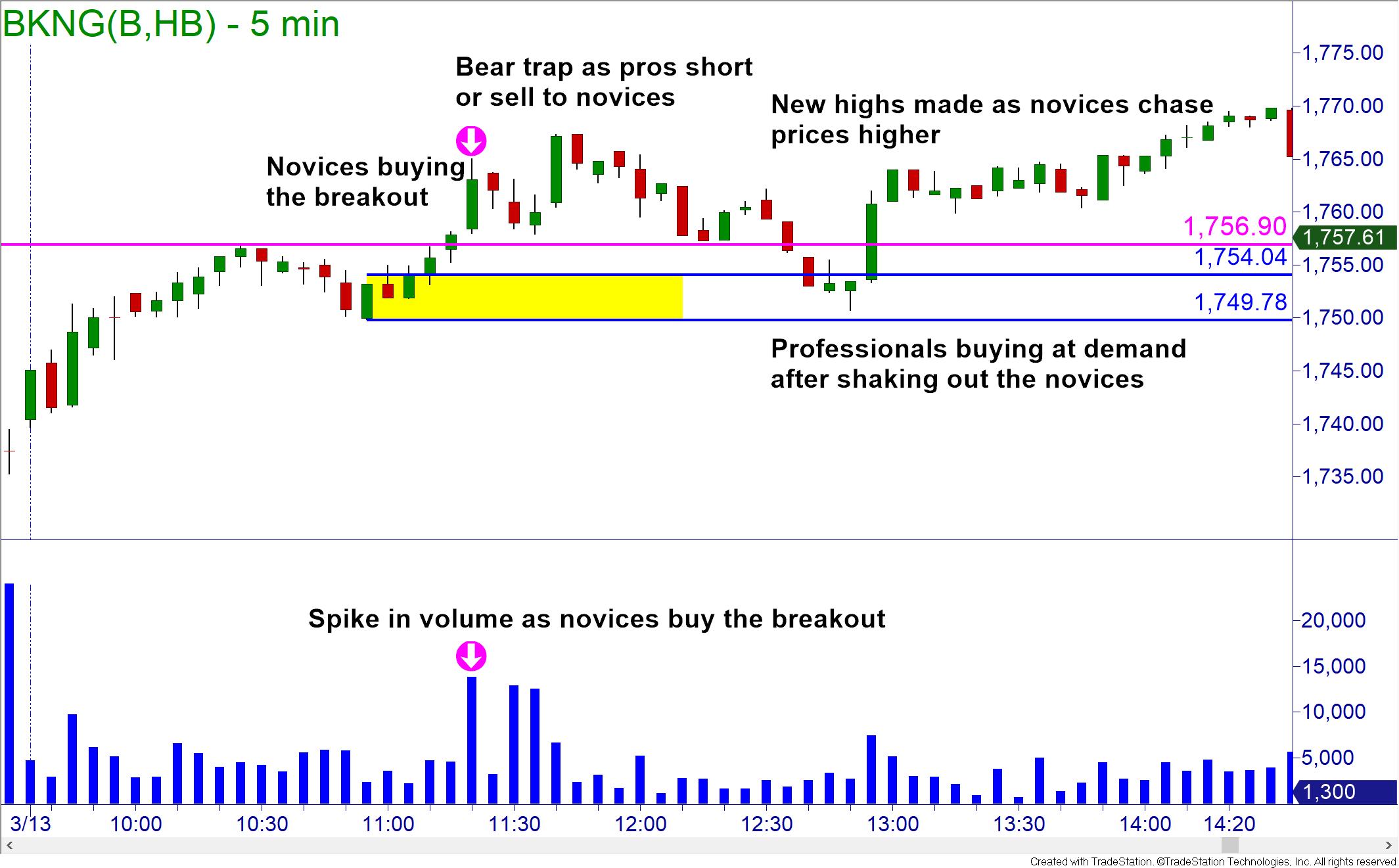

A bear trap stock is a downward share price that lures investors to sell short but then sharply reverses with the price moving positively. A Bear Trap in terms of trading is a strategy that institutions use to take advantage of the young traders that dont have the insight to recognise when they are being played. Bull trap also known as a bull trap in contrast to the bear trap is a sudden sharp rise in prices during a downtrend bearish market trend.

Markets move higher because of an imbalance between buying and selling pressure. Bear trap trading is also commonly associated with institutional investors. Get this must read guide.

A bear is an investor who believes that a particular security or market is headed downward and attempts to profit from a decline in prices. A bear trap denotes a technical pattern that occurs when the performance of a stock index or other financial instrument incorrectly signals a reversal of a rising price trend. A bear trap is an investing pattern that happens when a falling security reverses course and begins rising again temporarily or permanently.

Have a 500K portfolio worried about the stock market crashing. Ad With a Focus on Client Goals American Funds Takes a Different Approach to Investing. A bear trap stock is a downward share price that lures investors to sell short but then sharply reverses with the price moving positively.

A bear trap in trading is a false technical pattern that can be observed when the price of an asset on the crypto or stock market incorrectly shows a reversal of an upward trend. Support Level Bear Trap. Still if you know how to turn the situation in your favour you have chances to come out.

Here are some of the popular strategies to. When that stock reverses course or never goes down in the first place a bear. Bear trap is a financial trap set up by intelligent investors to force small investors to sell their investment assets such as crypto stock or commodity by investors.

A bear market in and of itself is an environment in which there is a high amount of pessimism. On May 20 the SP 500 index fell into. This move gets the attention of investors and.

A bear trap or bear trap pattern is a sudden downward price movement luring bearish investors to sell an investment short followed by a price reversal back upward. How this fund has thrived as the market tanked. Answer 1 of 4.

Investors will oftentimes bet against these stocks via short selling or other methods. In this situation the trap is set to. While not an indicator a bear trap is a technical trend or pattern that can be seen when the price.

Ad Use this guide to understand bear markets and what they mean for your financial goals. A good example of a bear trap can be found on the chart below. One such trap is the Bear Trap in Stocks.

This pattern incorrectly shows prices reverse to a. Ad Another Bear Market Another Positive Return For This Fund.

Bear Trap Stock Trading Definition Example How It Works

What Is A Bear Trap On The Stock Market

Bear Trap Best Strategies To Profit From Short Squeezes Tradingsim

Eurusd Bear Trap After Ecb Ewm Interactive

What Is A Bear Trap On The Stock Market

What Is A Bear Trap On The Stock Market Fx Leaders

What Is A Bear Trap In Stock Market Trading Quora

What Is A Bear Trap On The Stock Market Fx Leaders

What Is A Bull Trap In Trading And How To Avoid It Ig En

Https S Yimg Com Ny Api Res 1 2 Siaea2zqdxutdmn1weqolq Yxbwawq9aglnagxhbmrlcjt3pty0ma Https Media Zenfs Com En Fx Em Stock Market Bear Trap Smart Money

The Great Bear Trap Bull Trap Seeking Alpha

Bear Trap Best Strategies To Profit From Short Squeezes Tradingsim

What Is A Bear Trap Seeking Alpha

Bear Trap Meaning What It Is And How Do Bear Traps Work

Bear Trap Best Strategies To Profit From Short Squeezes Tradingsim

The Great Bear Trap Bull Trap Seeking Alpha

Bear Trap Trading Strategy Trading Strategies For Price Actions Bear Trading Strategy The Bear Trap Negotiatio Bear Trap Trading Strategies Business Rules

Don T Get Caught In A Bull Trap Tips To Avoid Getti Ticker Tape